Nigeria’s revenue-to-debt service ratio decreased from 97% in 2023 to 68% in 2024, according to Finance Minister Wale Edun, suggesting a decrease in the country’s total debt load.

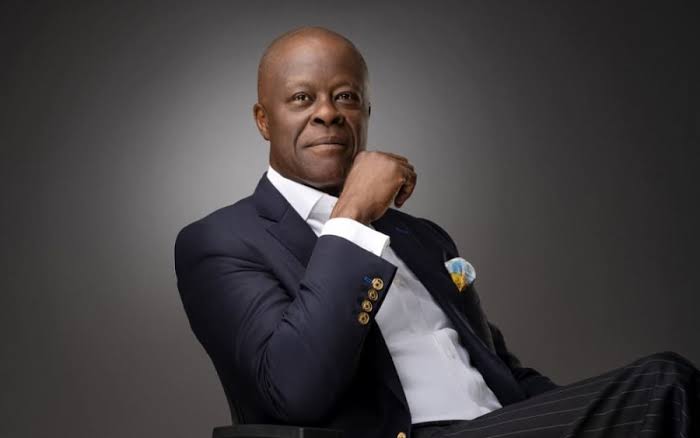

During a news conference with reporters on Thursday in Abuja, Edun made this claim.

According to the Minister, the management of the nation’s revenue today encourages accountability, openness, and visibility of government spending.

Edun claims that since the nation is no longer dependent on financial advances from the Central Bank to meet its budgetary responsibilities, its revenue situation has improved.

“The systems and procedures have been reorganised to provide increased accountability, openness, and visibility in government spending. That is how the people will trust the government to spend their money responsibly.”

“This government has abandoned its methods and is now borrowing.”

“Total debt service has declined from 97% of revenue in the first half of 2023 to 68% in 2024,” says Edun.

FG aims for an inflation rate of 20%

Furthermore, Edun stated that the federal government aims to achieve an inflation rate of 25–20% by the end of the year.

He mentioned this number. is also being indicated by the Nigerian Central Bank.

In order to promote economic growth and productivity, he continued, the government is offering incentives to the oil and gas and agriculture sectors.

As a result, Edun said, the government anticipates that Nigeria’s debt stock will drop to roughly $95 billion in US dollars.

“The focus is on inflation, production, and overall business support. The short-term stabilisation package’s execution plans will place special emphasis on boosting food inflation and fostering a more favourable environment for oil and gas investments.”

“By the time we have a successful harvest and can cut post-harvest losses, we estimate inflation to fall by 20 to 25%. The Central Bank has already given this indication.”

“We anticipate that the overall debt stock will be less than $95 billion in terms of dollars. Additionally, we anticipate budget deficits to be within the goal range of 4%,” said Edun.

What to note

Under President Buhari’s leadership, the federal government borrowed an astounding N27 trillion in advances through ways and means from the Central Bank.

The CBN’s debt infusion caused the economy to have an excess of money supply and increased cost-push inflation.

Yemi Cardoso, the recently appointed head of the CBN, claims that the effects of the system’s excess money supply are a major cause of the inflationary strain the economy is currently facing.

A 28-year high of 34.19% was reached in June by Nigeria’s inflation rate, as reported by the National Bureau of Statistics (NBS).

In order to control inflation, the Cardoso-led monetary policy committee keeps raising the interest rate, which is currently 26.75%.