Nigeria is directing both foreign and domestic capital towards infrastructure and other vital industries through the issuance of a new $500 million tax-exempt bond to both domestic and international investors.

The $500 million bond was introduced on Thursday by the Debt Management Office (DMO) and will be available to a wide spectrum of investors. Ten thousand dollars is the minimum investment level; further contributions are accepted in $1,000 increments. The goal of this structure is to encourage greater engagement from investors in Nigeria and abroad.

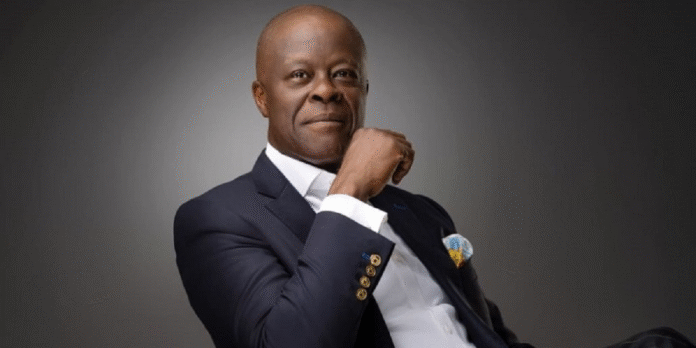

According to Wale Edun, the minister of finance and coordinating minister of the economy, “this bond issuance is more than just a financial instrument; it is a strategic move to channel funds into sectors that will catalyse economic growth” during the roadshow in Lagos.

“This bond issuance is just the beginning,” Edun explained. “We aim to mobilise resources effectively and channel them into the country’s development needs. This effort is consistent with our overall policy of utilising both domestic and foreign funds for infrastructure and other vital areas.”

Edun claims that the $500 million issue by the Nigerian government on Monday, August 19, 2024, will increase foreign exchange reserves.

According to data from the Central Bank of Nigeria (CBN), Nigeria’s external reserves rose by 11.66 percent to $36.87 billion as of August 7, 2024 from $33.02 billion on January 2, 2024, before slowing down to $36.54 billion as of August 14, 2024.

Nigeria decided to delay the issuance of its Eurobond this year in favour of introducing its maiden dollar bond to the local market. The goal of this action is to stabilise the weakening naira and finance the budget deficit.

“This historic issuance will provide critical foreign exchange liquidity and increase reserves, so stabilising the exchange rate, managing inflation, and eventually lowering interest rates. It will also pave the groundwork for increasing investment from both domestic and foreign direct investors,” the minister stated.

“We already experience a significant influx of foreign portfolio investments, and this will further enhance it. Regarding liquidity and risk management, the Nigerian economy currently generates about $55 billion in export revenues, which is expected to grow in both the oil and non-oil sectors. This growth will help manage liquidity and foreign exchange risks associated with raising and repaying these funds. Additionally, it introduces another avenue for foreign exchange financing, complementing the export sector and the Eurobond market.”

He stated that by interacting with Nigerians living overseas and in the diaspora, the transaction enables the government to get foreign exchange financing domestically. “It gives them a chance to enjoy a competitive and safe investment while bolstering the Nigerian economy.”

In response to an inquiry from an investor concerning the rationale for the bond’s acquisition, Edun stated, “The domestic issuance of the Federal Government’s U.S. dollar bond has been carefully planned and carried out. It started with a presidential executive order that authorised the issue of dollar bonds inside the confines of the domestic financial regulatory framework and capital market.”

“Crafted by the top experts in the Nigerian capital markets, who adhere to global best practices, this inaugural $500 million series is expected to be well-received by the market. We anticipate it will be fully subscribed, with demand potentially surpassing supply. This confidence stems from our belief in the strength of our financial system, the expertise of our financial professionals, and the trust that global and domestic investors have in this domestic U.S. dollar bond issuance.”

In his presentation, Gbadebo Adenrele, managing director of United Capital, stated: “One of the main characteristics of this bond offering is that it will be published on venues such as the Nigerian Exchange and FMDQ, making it accessible to a variety of investors. The principal will be reimbursed after five years, with six-monthly interest payments. This organised repayment schedule is intended to instill confidence in investors.”