The Bureaux De Change Operators Association of Nigeria (ABCON) opposes the industry’s recapitalization and advocates for the consolidation and merger of BDC operators.

It claimed that consolidation would enhance corporate governance and the apex bank’s rules of engagement.Class ‘A’ BDCs were given the option to merge in 2007/2008, giving them access to a weekly allotment of $1 million with a capital base of N500 million, according to the organization.

In a statement, the organization advocated for similar business models through mergers and consolidation rather than a thorough examination of each operator’s capital basis.

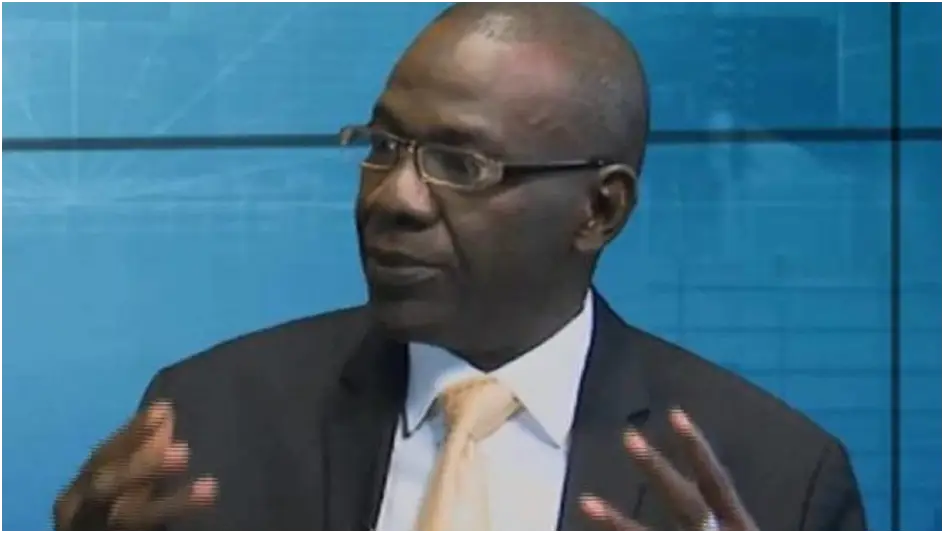

It claimed that as a result of the consolidation process, the Central Bank of Nigeria (CBN) would be in a stronger position to govern the BDCs. According to a statement from ABCON President Dr. Aminu Gwadabe, each of the BDCs with a license from the CBN is capitalized to the tune of N35 million and should be permitted to voluntarily consolidate among themselves.

Gwadabe claimed that the group requested a merger of at least 10 BDCs to create additional capital of N350 million rather than an increase in the allowed capital base for each BDC of N35 million.

He said that the change will broaden the operation’s scope and increase diversification through a number of windows. He said that combining several BDCs into one larger, more powerful organization would position them for a more important role in the financial system, including managing remittances from the diaspora or other offshore funds to expand FX access.

According to Gwadabe, the apex bank’s 2004 consolidation exercise involving the merger of several commercial banks is a model that the BDCs should follow in order to reduce their size and present controllable operators for maximum impact.