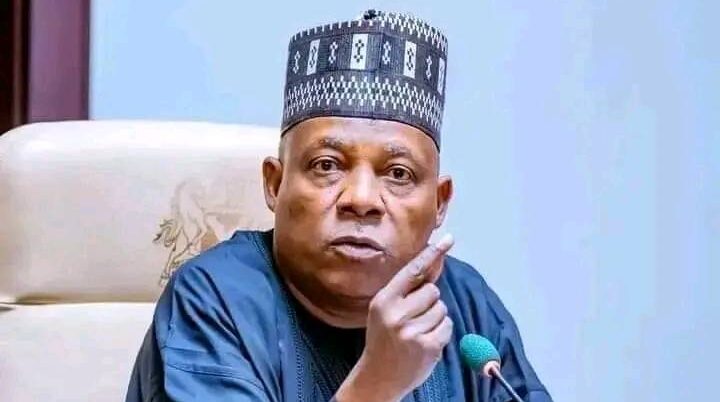

Nigeria’s Vice-President Kashim Shettima has summoned the Minister of State for Petroleum Resources (Oil), Senator Heineken Lokpobiri, and the Group Managing Director of the Nigerian National Petroleum Company Limited (NNPCL), Mele Kyari, to Aso Rock.

Also attending the meeting which is reportedly not unconnected with the recent increase in the price of Premium Motor Spirit (PMS) and the backlash that has greeted the development, is the National Security Adviser, Mallam Nuhu Ribadu alongside some officials of government from the office of the Vice President, Senator Kashim Shettima.

Recall that the NNPCL had on Tuesday September 3 jerked up the pump price of PMS to N885 per litre.

The latest hike in the price of petrol has pushed up transport fares by over 50 percent in major cities across Nigeria.

The newest price hikes, implemented by the Nigerian National Petroleum Company’s (NNPCL) Retail Management, range from N855 to N897 per litre, depending on the location, from the previous N568-N617.

Independent marketers have adjusted their prices to between N930 and N1,200 per litre of petrol.

The price hike has had a widespread impact, with some Nigerians resorting to long-distance trekking and others missing work as a result of the higher transportation costs.

The price increased two days after NNPCL’s Chief Corporate Communications Officer, Olufemi Soneye, announced that financial strain had placed considerable pressure on the company and posed a threat to the sustainability of fuel supply.

“In line with the Petroleum Industry Act (PIA), NNPC Ltd remains dedicated to its role as the supplier of last resort, ensuring national energy security. We are actively collaborating with relevant government agencies and other stakeholders to maintain a consistent supply of petroleum products nationwide”. He added in a statement.

According to documents from FAAC meetings in July and August, the NNPCL had told the Federation Account Allocation Committee (FAAC) of an outstanding of N4.56 trillion for selling petrol at a subsidized price between August 2023 and June 2024.

In a report from a FAAC Post-Mortem Sub-Committee (PMSC) meeting, the outstanding amount is said to be unrecovered funds arising from exchange rate differentials on petrol importation.