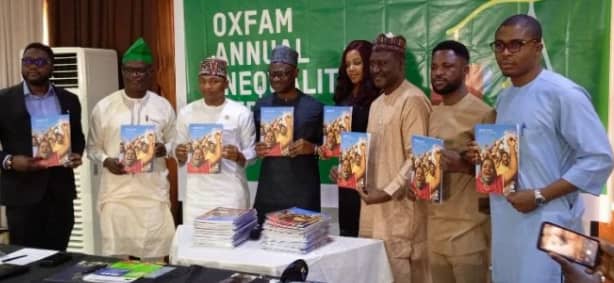

Oxfam recently published a report revealing that tax deductions for certain companies in Nigeria, including Dangote Sino Trucks West Africa Limited, Lafarge Africa Plc, Honeywell Flour Mills Plc, Jigawa Rice Limited, and Stallion Motors Limited, have reached a staggering N5 trillion.

This amounts to 18.5% of Nigeria’s 2024 budget. The tax breaks were approved under the pioneer status regime, allowing these companies to enjoy three to five years without paying corporate income taxes, aiming to stimulate their growth.

The report points out that the policy has led to a cumulative total of approximately five trillion naira, making up a significant portion of Nigeria’s federal government budget.

Oxfam emphasizes the impact of economic disparity in Africa, where the seven richest individuals possess more wealth than the poorest half of the continent’s population.

The report also highlights a global trend, noting that seven out of ten of the world’s largest corporations, some with a significant presence in Africa, have a billionaire as CEO or principal shareholder.

Oxfam’s Country Director in Nigeria, Hamza Ahmed, argues that the root cause of poverty lies in the fact that the top 1% has disproportionately controlled available resources, coupled with a lack of deliberate government investment in critical sectors.

Oxfam calls on governments, particularly the Nigerian Senate, to address this issue by amending the Federal Inland Revenue Service Act to regulate the processes of granting corporate tax holidays and incentives.

They advocate for transparency in the granting of incentives, suggesting parliamentary oversight and public debate on tax expenditures.

The organization urges the government to establish a public dashboard for access to data on tax incentives, promoting awareness and trust.

Connected Development CEO, Hamzat Lawal, expresses concern over the inequality, emphasizing the need for a fair tax regime to prevent anarchy.

He questions the allocation of over 5 trillion naira in tax breaks while the government claims budget constraints and borrowing needs.

CISLAC Executive Director, Ibrahim Rafsanjani, adds that the absence of a proper taxation system contributes to the government’s financial losses.

He criticizes the lack of monitoring for corporate tax holidays, suggesting that corruption may be influencing these decisions.

Rafsanjani advocates for beneficial ownership transparency to identify those benefiting from tax breaks and calls for a focus on social corporate responsibility to address developmental challenges in Nigeria.