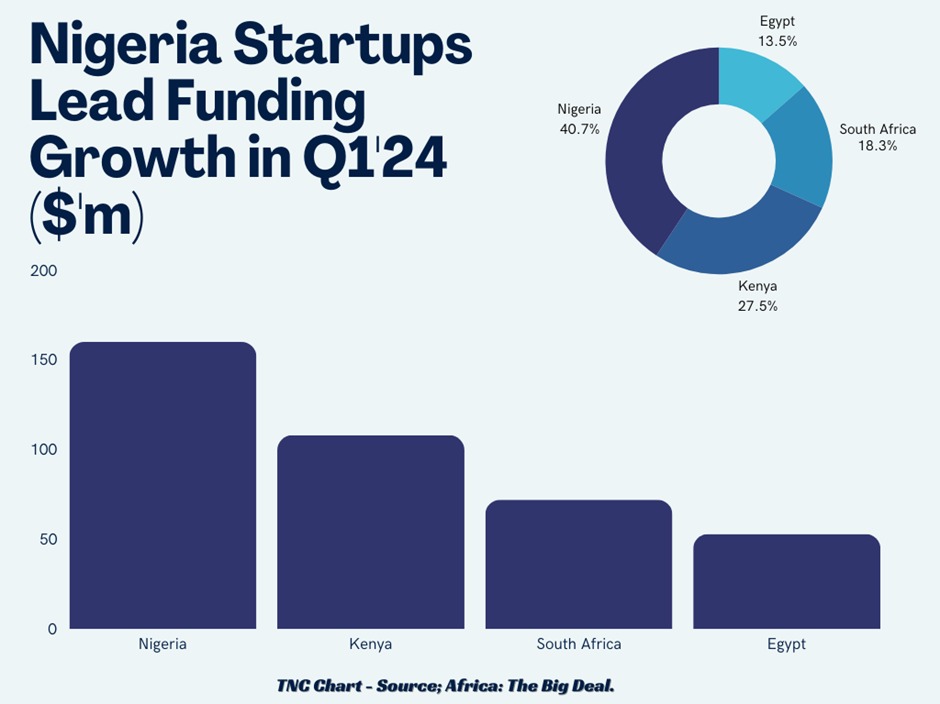

Nigerian startups garnered $160 million in capital in the first three months of this year, despite a slowdown in fundraising throughout the continent, according to a new analysis from Africa: the Big Deal.

The research states that throughout this time, 87 percent of all startup investments made in Africa went to Nigeria, Kenya, South Africa, and Egypt.

Of the Big Four, Nigeria has the most funding ($160 million), followed by Kenya ($110 million), South Africa ($72 million), and Egypt ($53 million).

“Startups based in these four countries received 87 percent of the investment, with Nigeria and Kenya receiving the majority. Only a few other African countries received more than $5 million in support,” the report stated.

African entrepreneurs raised $370 million in disclosed investment across 120+ deals in Q1, according to Briter Bridges’ first-quarter analysis report. This is a 61 percent decrease in funding volume from Q1 2023.

African startups are tenacious in the face of adversity; many are still innovating and developing fresh business strategies to propel the industry’s expansion.

African startups are tenacious in the face of adversity; many are still innovating and developing fresh business strategies to propel the industry’s expansion.

According to the research, “Investors must now recognize the potential of the African tech ecosystem and provide these startups with the necessary support to succeed.”

According to Prashant Matta, SP of Panache Venture, speaking to BusinessDay, the reduction in investment is a global problem that is made worse by persistent economic difficulties such as recessions, inflation issues, and downturns.

Nonetheless, given the large acquisitions that were reported in Q1, investors have high hopes for Nigerian businesses.

It stated, “The $100 million+ investment in Nigerian mobility fintech startup Moove. This finance, like that of other megadeals, originated outside of Africa. Mubadala and Chimera Investments, two Middle Eastern investors, took part in the mega-rounds in both quarters.”

The Big Deal report states that with $151 million from 14 agreements in the first quarter of the year, the logistics and transport industry brought in the most funding.

“Transport and logistics took the top spot in terms of total funds raised. Uber’s $100 million series B round received more than 24 percent of the capital on the continent in Q1, whereas Africa Moove’s company raised $110 million in Q1 2024.”

With $105 million, fintech received the second-highest amount of capital. Agriculture and food came next, raising $50 million, then energy ($49 million), and healthcare ($45 million).